13 bookkeeping tips every small business can benefit from

For example, there’s cash basis accounting and accrual basis accounting. You need to decide which accounting method you will use for your company. Either way, it’s critical to have an accurate balance there are two main types of bookkeeping sheet and income statements. These are individual entries in journals or ledgers that summarize each business transaction. Accountants use these journals to prepare your financial statements.

How To Choose Your Accounting Path

Forensic accounting also involves investigating complex financial transactions, tracing the flow of funds, rebuilding financial records, and assessing damages. The findings of these operations are used in legal proceedings, where forensic accountants need to present their analysis, as expert witnesses. This means that double entry bookkeeping provides a more accurate picture of your finances, however it can also be more difficult to manage.

Accounts Receivable

Also, arithmetic errors in the account totals are relatively common. After these two main bookkeeping categories, we have equity or the difference between the company’s assets and liabilities. Incoming finances are your income/revenue, which is all the money earned, sales, and profits. In turn, they become assets, which are all the existing property owned by your business.

Bookkeeping vs. Accounting

Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. But if you have the time to dedicate to updating your books regularly, doing your own bookkeeping may be feasible. Now that you’ve got a firm grasp on the basics of bookkeeping, let’s take a deeper dive into how to practice good bookkeeping. There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards.

- There is an array of bookkeeping apps that sync with cloud-based software, ensuring that the data is consistent and securely backed up.

- Bookkeeping is the meticulous art of recording all financial transactions a business makes.

- It gives a clear picture of how your company is spending and receiving money.

- You use this to calculate the COGS, and you subtract it from sales to determine the company’s gross profit.

- Accountants use these journals to prepare your financial statements.

- This is often the account that nobody likes and that’s because this is the one that allows you to see clearly what money is leaving or has left the business and when.

The more active is the business, the trickier it is to keep tabs on your cash flow. If you have more questions about your business’s bookkeeping or accounting needs, reach out to a Chase business banker. It’s certainly possible for business owners to do their own bookkeeping. However, ask yourself whether you have enough time and patience to tackle it yourself. You may decide that you’d be better off hiring an outside expert so that you can focus on other aspects of running your business.

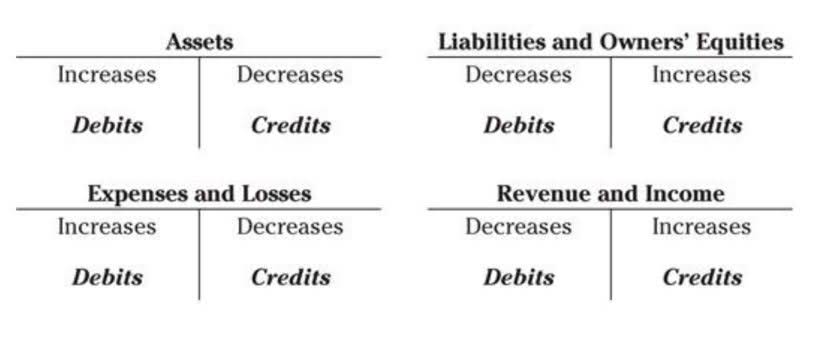

The single-entry bookkeeping system records each transaction as a single entry and is well-suited for small, simple businesses. In contrast, the double-entry system records transactions as both a debit and a credit, providing a more comprehensive financial picture and is essential for larger enterprises. It’s essential for businesses to devote time and money to keeping accurate financial reports. Ultimately, when you have a balanced bookkeeping system, you can rest assured that you also have an accurate indicator of measurable success. In doing so, businesses of all sizes and ages can make strategic plans and develop realistic objectives.

Know your business expenses

- A journal can be either physical (in the form of a book or diary), or digital (stored as spreadsheets, or data in accounting software).

- Plus, detailed records make it easier to get ready for tax time — and easier to impress potential investors, too.

- To better understand these concepts and how to apply them, take bookkeeping courses that will allow you to practice them.

- In fact, a business can legally lower its tax liability by simply controlling the timing of the cash payments.

- Accounting is the umbrella term for all processes related to recording a business’s financial transactions, whereas bookkeeping is an integral part of the accounting process.

Meticulously record every cash transaction, whether it’s a sale or a purchase, to accurately track your cash flow. Regularly reconcile your records with your bank statements to ensure all deposits, withdrawals, and bank fees are accounted for. This process will identify any discrepancies, like missing checks or deposits, and maintain a clear picture of your actual cash balance. If you’re a small business with a limited number of transactions, single entry bookkeeping may be sufficient. However, if you’re a larger business with more complex transactions, you may find that a double entry bookkeeping system is a better fit.

この記事へのコメントはありません。